Here comes the fun stuff…you must assess your current situation. I think this area becomes the biggest roadblock for most folks. They don’t want to realistically face what they’ve been hiding from. Is that you?

Assessing Your Net worth

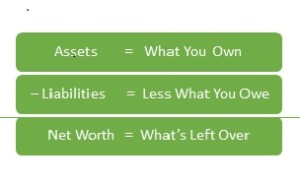

Honestly take a good look at all of your numbers. You need to know that your true net worth is. Net worth is defined by total assets, which are things you own, minus total liabilities, which are things you owe. If your total assets are greater than your total liabilities, then you will have a positive net worth. If your total liabilities are greater than your total assets, then you will have negative net worth. If you find that you have a negative net worth, don’t fret. Many who are just starting out, or have large liabilities such as mortgages may find themselves in this position. It’s ok. That’s why we are trying to position you to move toward a positive net worth. There are many tools out there that can help you figure out what goes into what category.

Know Your Income and Expenses

Jot down all of what you earn and list all of your expenses. lnclude savings and investments as an expense. Think of it like paying yourself first. Consider the opportunity to utilize an employer sponsored retirement plan 401K or 403b. The benefits of these plans include automatic deductions from your paycheck. You also get to reduce taxes that you are currently paying. Also oftentimes employers offer free $$ with matching (some match up to certain %)

Evaluate Your Savings Plan You may be thinking to yourself “but l spend everything I make!” It’s time to adjust and look for ways to cut back. Perhaps you can get rid of that cup of coffee or cigarettes.

Example: If you buy a cup of coffee every day for $1.OO (an awfully good price for a decent cup of coffee, nowadays), that adds up to $355.OO a year. If you saved that $365.OO for just one year, and put it into a savings account or investment that earns 5% a year, it would grow to $465.84 by the end of 5 years, and by the end of 3O years, to 91,577.50.This my friends is – the power of compounding!

For those of you who are impulse buyers – consider waiting 24 hours to buy that item. You may find that your desire is gone after 24 hours

Empty pockets of spare change each day. lt adds up. (A former coworker cashed in $14,000 that he accumulated in a huge water cooler bottle over a couple of years.)

Create an emergency savings fund. You will have funds that can be pulled for unexpected expenses, layoffs, and medical bills that may pop up. It reduces the need to use credit cards. Before experts were recommending saving 3-6 months but now in this environment Gurus like Suze Orman recommend aiming to save 8-12 months; set aside in a liquid account (such as a regular bank account or in a credit union) . Also there’s no penalty to take money out in a pinch.

Disclaimer: The purpose of this blog post is to serve as a point of reference and it is for informational purposes only regarding the topic of personal finance. I will attempt share lessons and information that I’ve learned along the way. While I do have over 10 years of experience in the financial market, this blog should not serve as your main source of financial advice nor does this blog serve as a solicitation for clients. You should ALWAYS do your own research and consult your own financial professional when making decisions about your personal financial future.

Leave a Reply